IRS W-12 2025-2026 free printable template

Instructions and Help about IRS W-12

How to edit IRS W-12

How to fill out IRS W-12

Latest updates to IRS W-12

All You Need to Know About IRS W-12

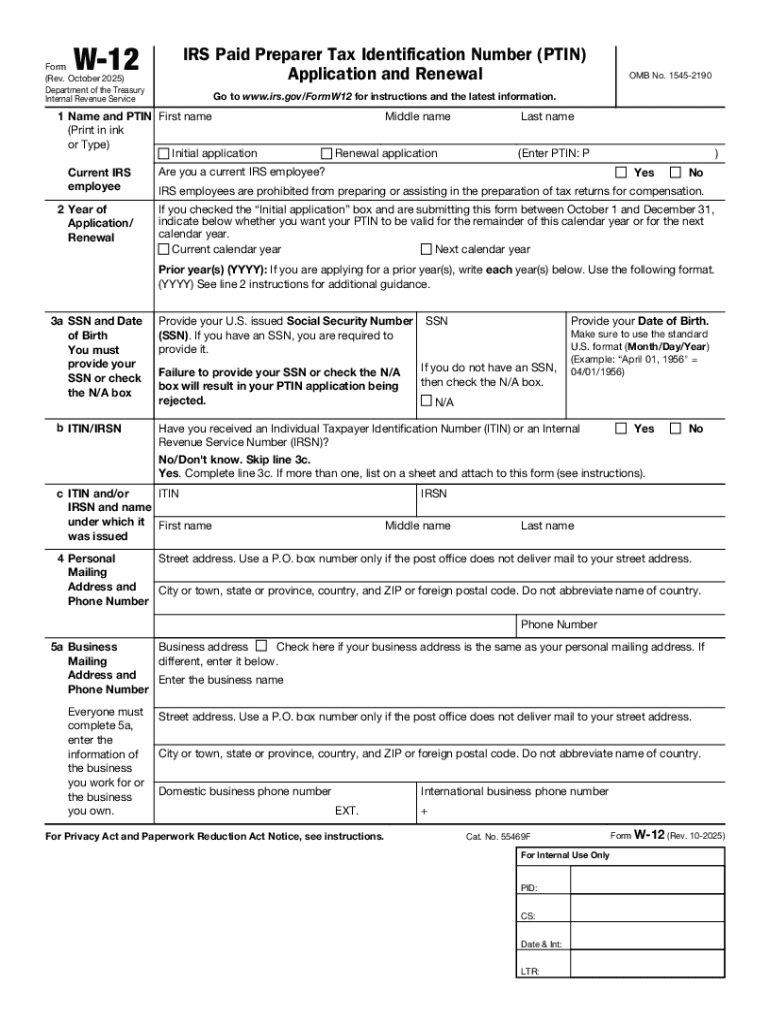

What is IRS W-12?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS W-12

What should I do if I realize I've made a mistake on my IRS W-12 after submitting it?

If you discover an error after filing your IRS W-12, you can submit a corrected form. It's best to send a new IRS W-12 indicating the corrections made. Make sure to include a brief explanation of the changes to avoid confusion. Always keep a record of the original and corrected form for your files.

How can I track the status of my IRS W-12 submission?

To verify the receipt and processing of your IRS W-12, you can use the IRS online tool available for tracking submissions. Additionally, check for any communication from the IRS regarding your submission status. If you encounter common e-file rejection codes, refer to the IRS guidelines to resolve them swiftly.

What should I know about e-signatures when submitting the IRS W-12?

When filing the IRS W-12 electronically, e-signatures are generally accepted, provided they meet the IRS requirements. It's important to ensure that your e-signature process is secure and complies with IRS guidelines to protect your data. Maintain records of your electronic submissions for at least three years.

What are some common errors people encounter when filing the IRS W-12?

Frequent mistakes in filing the IRS W-12 include incorrect tax identification numbers and omissions of necessary information. To reduce errors, double-check all entries and ensure that the information matches IRS records. Familiarize yourself with common pitfalls to avoid these issues in future submissions.

How do I respond if I receive a notice from the IRS regarding my W-12 submission?

If you receive an IRS notice related to your W-12, carefully read the correspondence and follow any outlined instructions. Be prepared to provide additional documentation or explanations as required. Respond promptly and maintain detailed records of all correspondence to ensure compliance and clarify any discrepancies.