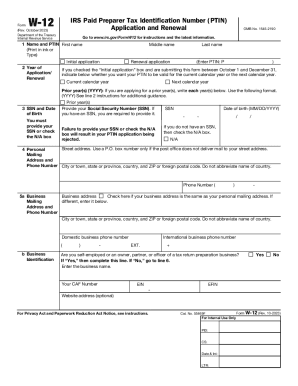

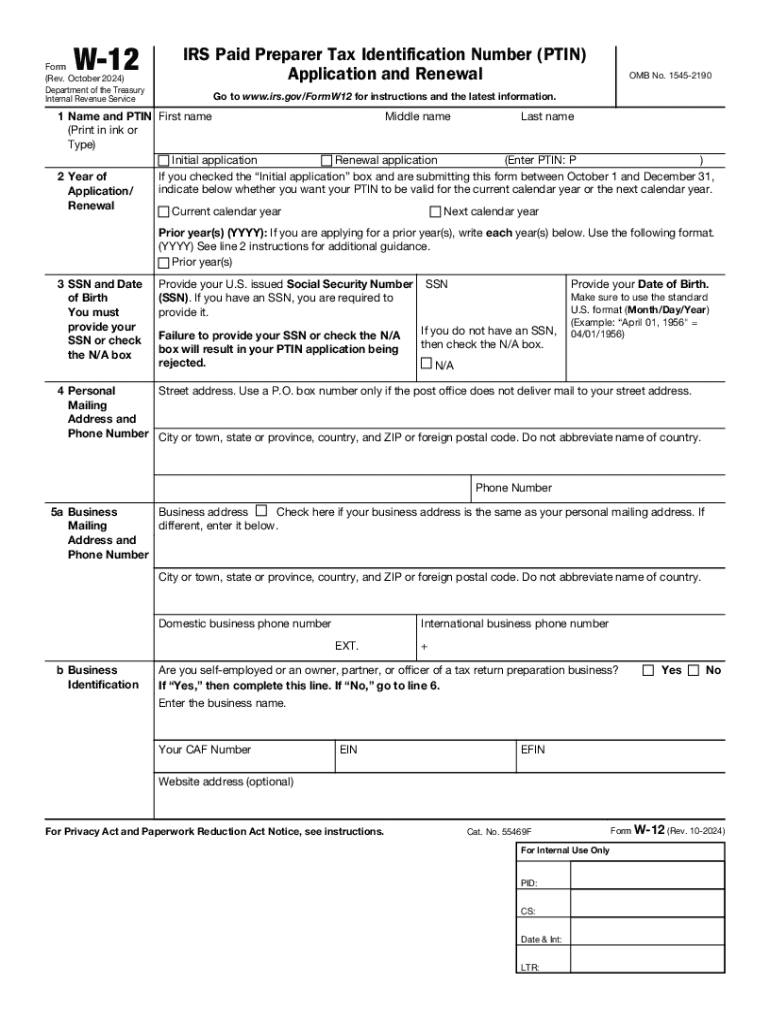

IRS W-12 2024-2025 free printable template

Show details

If you have an SSN you are required to provide it. Failure to provide your SSN or check the N/A box will result in your PTIN application being rejected. Provide your Date of Birth. W-12 Form Rev. October 2024 Department of the Treasury Internal Revenue Service IRS Paid Preparer Tax Identification Number PTIN Application and Renewal OMB No. 1545-2190 Go to www.irs.gov/FormW12 for instructions and the latest information. 1 Name and PTIN First name Middle name Last name Print in ink or Type...

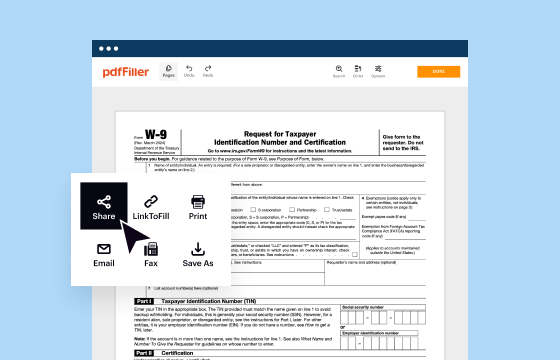

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS Form W-12

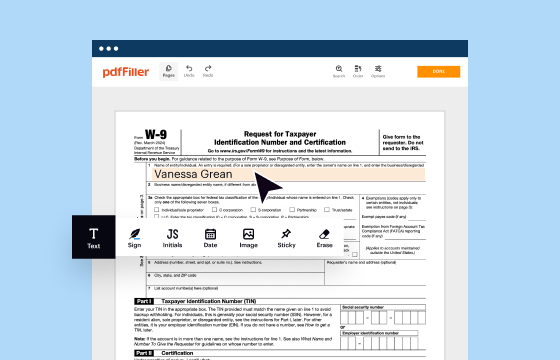

Guidelines for Editing the IRS W-12

Completing the IRS W-12 Form

Understanding and Utilizing IRS Form W-12

The IRS W-12 is a crucial form used by taxpayers in specific scenarios, primarily to claim an exemption from backup withholding. Understanding how to accurately complete and submit this form is essential for compliance and to avoid penalties. Below, we delve into step-by-step instructions for editing and filing the W-12, recent updates about the form, and key insights regarding its purpose and use.

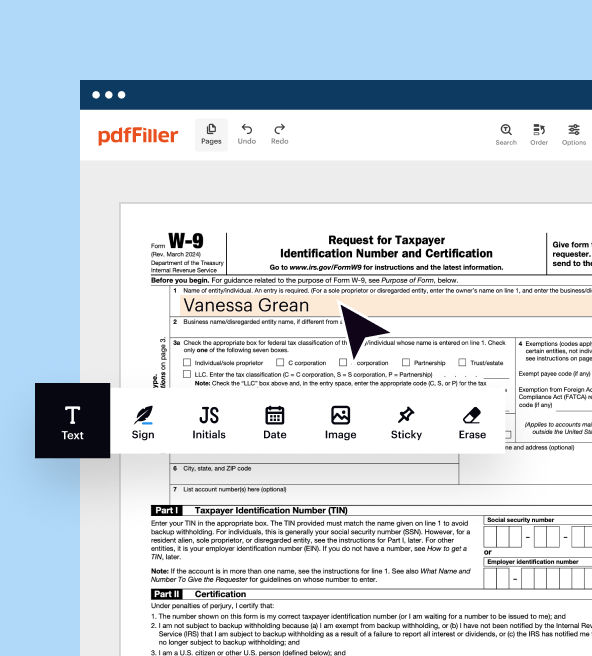

Guidelines for Editing the IRS W-12

Editing the IRS W-12 requires careful attention to detail to ensure accurate information is reported. Follow these steps:

01

Access the most current version of the IRS W-12 form on the official IRS website.

02

Begin by entering your personal identification information, including your name, address, and Social Security number.

03

Review any pre-filled information, such as your previous year’s data, ensuring it remains accurate. If corrections are needed, update the fields accordingly.

04

Confirm the eligibility criteria for claiming an exemption from backup withholding by checking the listed conditions.

05

Save the edited document securely before submission to prevent any loss of data.

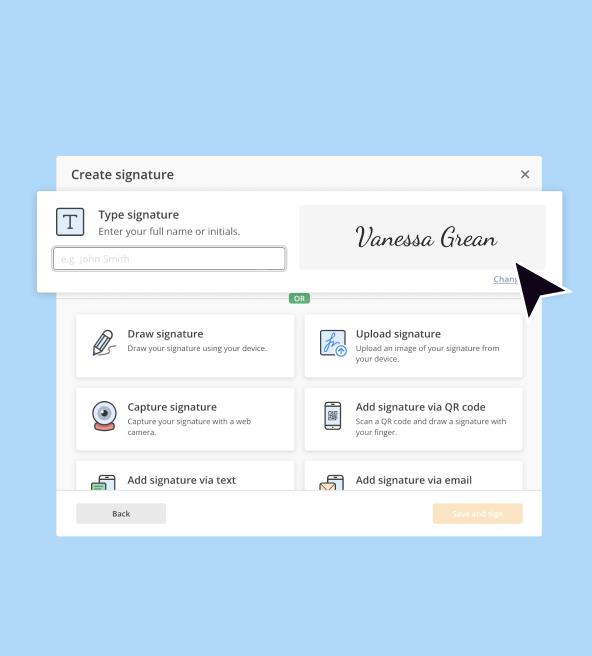

Completing the IRS W-12 Form

To accurately complete the IRS W-12, follow these guidelines:

01

Fill in your full name and mailing address in the designated sections.

02

Provide your taxpayer identification number, which is typically your Social Security number.

03

Specify the reason for exemption under backup withholding, ensuring you meet one of the defined criteria.

04

Review the completed form for accuracy, verifying that all information is consistent and complete.

05

Sign and date the form before submission to validate the request for exemption.

Show more

Show less

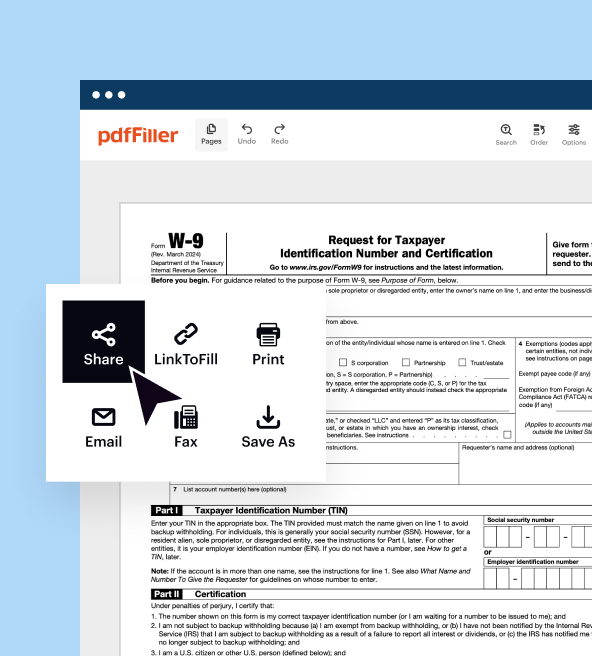

Recent Developments Surrounding IRS W-12

Recent Developments Surrounding IRS W-12

It is vital to stay updated on recent changes to the IRS W-12 to ensure compliance. Notable revisions include:

01

Adjustments to income thresholds for backup withholding exemptions, requiring revisiting eligibility criteria annually.

02

Introduction of new guidelines regarding the types of income covered under the exemption clause.

03

Increased emphasis on electronic filing options, promoting efficiency and accuracy.

Essential Information Regarding the IRS W-12

Defining IRS W-12

Purpose of IRS W-12

Who Needs to Complete the W-12?

Conditions for Exemption

Components of IRS W-12

Filing Deadline for IRS W-12

Comparing IRS W-12 with Other Forms

Transactions Covered by IRS W-12

Number of Copies Required for Submission

Consequences of Failing to Submit IRS W-12

Information Required for Filing IRS W-12

Supporting Forms that Accompany IRS W-12

Where to Submit IRS W-12

Essential Information Regarding the IRS W-12

Defining IRS W-12

The IRS W-12 is a form that allows certain taxpayers to request an exemption from backup withholding for certain payments, typically for interest and dividends. This form is primarily used by individuals, corporations, and other entities to officially notify the IRS of their exemption status.

Purpose of IRS W-12

The primary purpose of the IRS W-12 is to provide the IRS with necessary information to establish a taxpayer’s eligibility for exemption from backup withholding. This helps ease tax obligations for those who meet specific criteria.

Who Needs to Complete the W-12?

This form is primarily intended for individuals or businesses that receive income subject to backup withholding but believe they qualify for an exemption. Examples include nonresident aliens or those whose income is below a certain threshold, making them exempt by IRS standards.

Conditions for Exemption

Several conditions allow for exemptions from the IRS W-12 requirements:

01

Taxpayers whose income is below the IRS-defined threshold for tax year.

02

Individuals or entities receiving income types specifically excluded from backup withholding.

03

U.S. citizens and resident aliens fulfilling specific IRS criteria.

Components of IRS W-12

The W-12 consists of specific sections that gather required information, including:

01

Personal identification details.

02

Reason for exemption status.

03

Signature and date acknowledgment.

Filing Deadline for IRS W-12

While the IRS does not impose a specific deadline for filing W-12, it should be submitted alongside the tax return or any related paperwork involving payments subject to backup withholding.

Comparing IRS W-12 with Other Forms

The IRS W-12 is often compared to IRS Form W-9. While W-9 is used to provide identification for tax purposes without claiming an exemption, W-12 specifically focuses on declaring exemption status from backup withholding. Understanding the distinctions can help ensure the proper forms are submitted based on individual circumstances.

Transactions Covered by IRS W-12

The W-12 is primarily relevant for transactions involving dividends, interest income, and certain payments made by brokers or financial institutions that may typically be subject to backup withholding.

Number of Copies Required for Submission

Typically, one completed copy of the IRS W-12 is required for submission unless otherwise specified by the IRS or related tax documentation.

Consequences of Failing to Submit IRS W-12

Failure to submit the IRS W-12 can result in significant penalties, including:

01

A flat penalty amount for each form not submitted, which can vary based on the number of consecutive years.

02

Increased tax liabilities due to backup withholding, which could lead to potential legal challenges or financial strain.

03

Possible interest charges on unpaid backup withholding amounts.

Information Required for Filing IRS W-12

When filing the W-12, required information includes your name, address, Social Security number, and specific details about the type of income qualifying for the exemption.

Supporting Forms that Accompany IRS W-12

While the W-12 is primarily a standalone form, it may sometimes be submitted alongside other IRS forms such as the W-9 or W-4, depending on the taxpayer's unique situation.

Where to Submit IRS W-12

Completed IRS W-12 forms should be submitted to the appropriate recipient, such as your employer or the financial institution involved in the payment. Alternatively, you may need to send it directly to the IRS or retain it for your records, based on your specific situation.

Understanding and properly utilizing the IRS W-12 is essential to ensuring you don't incur unnecessary penalties and can accurately manage your tax obligations. If you’re uncertain about your status or need assistance with the submission process, consider reaching out to a tax professional for guidance.

Show more

Show less

Try Risk Free

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.